Can’t Afford A Lawyer helps Floridians get a fresh financial start with affordable, judgment-free bankruptcy solutions. Learn about our mission, our process, and how we make legal help accessible to everyone.

"Christine helped me regain control of my finances. I never felt judged, only supported."

Overwhelmed by debt?

You can start your path to

A FRESH START

with Chapter 7 Bankruptcy

for Only $99 down.

Talk with a Debt Relief Specialist about whether Chapter 7 bankruptcy can stop creditor calls, lawsuits, and wage garnishments—without paying thousands upfront.

Virtual Florida Bankruptcy Law Firm

Fast, judgment-free, fully virtual help for Florida consumers.

Free, no-pressure call with a Debt Relief Specialist—not a sales closer.

- $99 down to start your Chapter 7 case

- Payment plans available for qualified clients

- Plain-English answers in about 30 minutes

Start Your Fresh Start

$99 down gets you started. Answer a few quick questions and pick a time that works for you.

Secure and confidential. You’ll speak with a Debt Relief Specialist, not be judged.

How It Works

Simple, clear steps to a fresh start

Bankruptcy is a legal process, but your next steps don’t have to feel complicated. We keep it human and in plain English.

Step 1

Schedule Your Free Debt Relief Call

Pick a time that works for you. You’ll speak with a Debt Relief Specialist in a calm, judgment-free space to see if Chapter 7 may be right for you.

Step 2

Start With $99 Down & Set Up a Payment Plan

If you qualify and choose to move forward, you can get started with $99 down and set up an affordable payment plan of up to 8 months.

Step 3

Upload Your Documents Securely

Submit required documents online at your convenience for attorney review — no office visits needed.

Step 4

We Prepare and File Your Case

Our team prepares your Chapter 7 filing and submits it electronically when you’re ready.

Step 5

Attend Your Online 341 Meeting

The required trustee meeting is typically held virtually, so you attend from home.

Step 6

Receive Your Discharge and Fresh Start

Most cases are completed in a few months, and eligible debts are discharged.

Most calls take 20–30 minutes and are focused on understanding your financial situation, not pressuring you.

Why Can’t Afford A Lawyer

Built for people who think they can’t afford help

Most people who need bankruptcy relief don’t have thousands of dollars sitting in the bank. This firm exists for you.

- Payment plans exist because most people can’t pay thousands upfront.

- Virtual practice means lower overhead and more affordable fees for you.

- Focused exclusively on Chapter 7 bankruptcy for individuals and consumers.

- Fast filings when clients are ready and documents are complete.

- No scare tactics. No lectures. No judgment—just honest guidance.

About Attorney Chris

Bankruptcy help that feels human, not intimidating

I’m Attorney Christine Hansley—most clients just call me Attorney Chris. I created this Firm to focus on helping everyday people use Chapter 7 bankruptcy to get a real fresh start.

Clients come to this firm feeling embarrassed, scared, and exhausted. My job is to make the law understandable, give you clear options, and respect your decisions.

This virtual firm serves clients across Florida. By staying online and focused on Chapter 7, I can keep fees more manageable while still giving you direct access to an attorney.

Mission: make bankruptcy more accessible, less confusing, and less out-of-reach for people who feel like they have no options left.

Why a Virtual Law Firm Makes Filing Chapter 7 Easier

Lower costs. No large, full-time office overhead means more affordable fees and payment plans, including $99 down to get started.

Faster process. Upload documents, sign forms, and move your case forward without waiting weeks for in-office appointments.

24/7 access to reach our office. You can contact us and submit documents anytime. Messages are monitored regularly, and our team responds as quickly as possible.

No time off work. From intake to filing, everything is handled online.

Online 341 meeting. The required meeting with the bankruptcy trustee is typically held virtually, so you attend from home without traveling to court.

In-office appointments when truly needed. While most clients are served virtually, limited in-office appointments are available for special circumstances.

More privacy. Communicate comfortably and confidentially in a judgment-free environment.

Built for modern bankruptcy. Chapter 7 cases are filed electronically and designed to be handled virtually from start to finish.

Same legal protection. Less stress.

Just a simpler way to get a fresh start.

Payment Plans & Pricing Philosophy

Start for $99 down. Clear, realistic payment options.

The goal is to make relief possible—not to add another impossible bill to your life.

- $99 down to begin the Chapter 7 process.

- Up to 8-month payment plans for qualified clients.

- You can pay off your balance early at any time.

- You’ll know the fees and timeline before you commit.

- Protection from creditors starts once your case is filed, not when every payment is made.

$99 to get started

On your free call, we’ll walk through:

- What filing would look like for you

- A realistic payment plan, if you qualify

- When your case could be filed

No surprise fees. No "gotcha" clauses. You’ll know exactly what to expect before you move forward.

Talking is free. Deciding is up to you.

Questions You May Have

Frequently asked questions

If you’re worried about making a mistake, you’re not alone. These are some of the most common questions we hear from people considering bankruptcy.

Is $99 really enough to get started?

Yes. The $99 allows you to begin the process, get your questions answered, and see if Chapter 7 is right for you. We’ll talk through your full fee and payment options before you decide whether to move forward.

Do I have to pay everything upfront?

No. We offer affordable payment plans for qualified clients, with options up to about 8 months. Many people choose a plan so they can move toward filing without waiting to save a large lump sum.

Will filing bankruptcy stop creditor calls and lawsuits?

In most cases, yes—once your Chapter 7 case is filed, a court order called the automatic stay goes into effect. This can stop most collection calls, garnishments, and many types of lawsuits. We’ll explain how this applies to your specific situation.

Do I have to come into an office or attend court in person?

No. Can’t Afford A Lawyer PLLC is a fully virtual law firm. Consultations and most case work are handled by phone, video, and secure online tools, so you can move forward from home anywhere in Florida. Additionally the court hearing to review your case is done on zoom so you do not have to travel to the court.

What if bankruptcy isn’t right for me?

Then you should know that before you file. During your free call, we’ll walk through your situation and talk about whether Chapter 7 makes sense, what it can’t fix, and what other options you may have so you can make an informed decision.

Proof that Bankruptcy Works

We’ve successfully helped thousands of clients stop lawsuits and garnishments.

Here are just a few examples of real court dismissal orders and garnishment releases

(names & personal information redacted for privacy)

Ready to find out if Chapter 7 can help you?

Schedule your free Debt Relief Call. We’ll talk through your debt, your goals, and what bankruptcy would realistically look like for you.

- Free, confidential conversation—no obligation to hire us.

- You speak with a Debt Relief Specialist, not a sales closer.

- If you’re a good fit and choose to move forward, you can start for $99 down.

Most people leave the call feeling clearer and less alone—even if they’re not ready to decide yet.

Book Your Call

Choose a time that works, answer a few short questions, and we’ll confirm your appointment by email or text.

If you prefer, you can let us know in the form whether you’d rather talk by phone or video.

What people are saying

Real Google Reviews

See what real clients have said about their experience working with us.

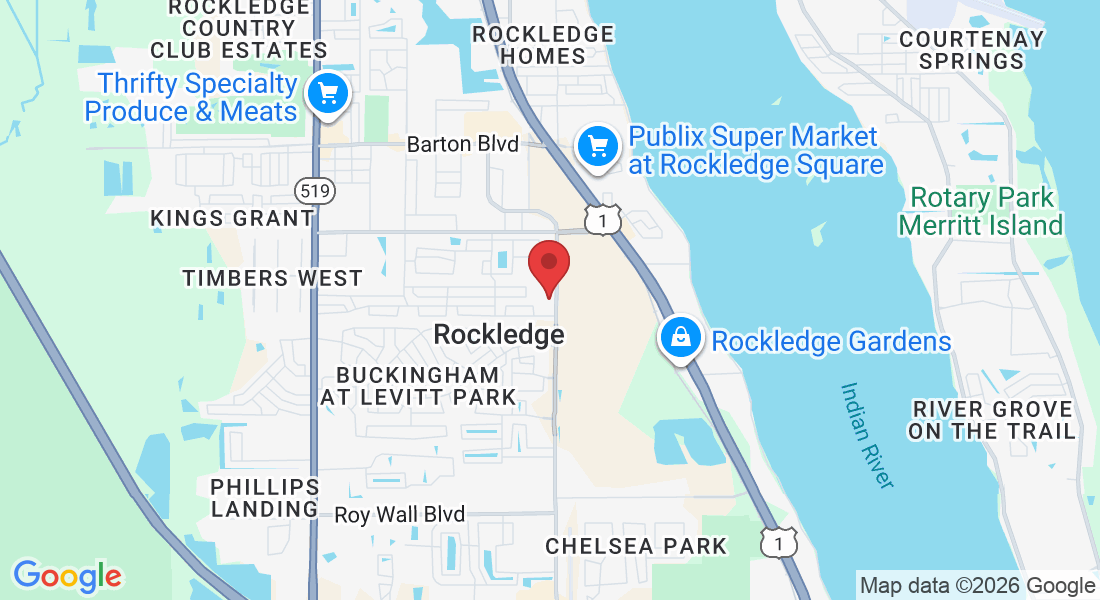

Office Locations

- Main Office — Brevard County: 835 Executive Lane, Suite 110, Rockledge, FL 32955

- Orange County (Satellite): 1802 N Alafaya Trail, Orlando, FL 32826

- Lake County (Satellite): 322 N Barrow Ave, Tavares, FL 32778

- Altamonte Springs (Satellite): 283 Cranes Roost Blvd, Suite 111, Altamonte Springs, FL 32701

- Volusia County (Satellite): 2500 W International Speedway Blvd, Suite 900, Daytona Beach, FL 32114

Serving clients across Florida

Main office and regional satellites.

In-office appointments when truly needed.

While most clients are served virtually, limited in-office appointments are available for special circumstances by APPOINTMENT ONLY.

Important information & disclaimer

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.

Can’t Afford A Lawyer PLLC is a law firm located in Florida. Attorney Christine Hansley is licensed to practice law in the State of Florida. This website is attorney advertising and is intended for Florida residents only.

Nothing on this site is legal advice, and visiting this site or scheduling a call does not create an attorney–client relationship. Any results discussed are examples only. Results vary by case, and no outcome is guaranteed.

Bankruptcy has long-term financial and legal consequences. Before filing, you should understand how a Chapter 7 case may affect your credit, property, and debts. We are happy to discuss these issues with you during your consultation so you can make an informed choice.